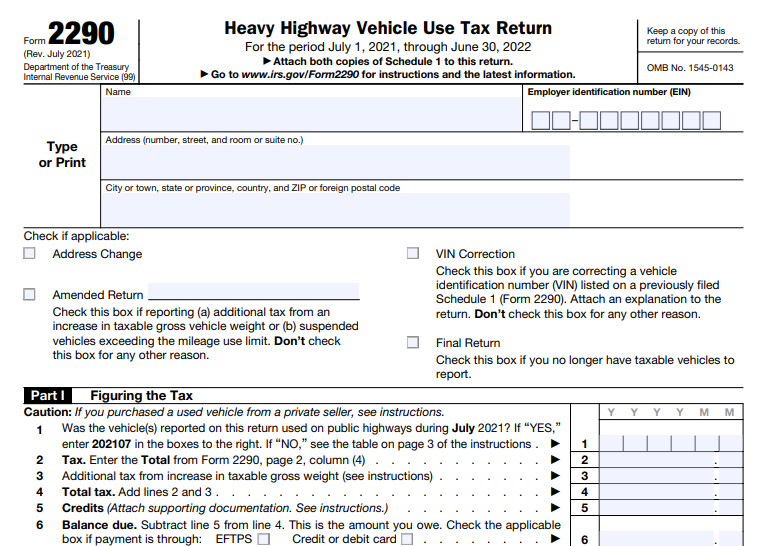

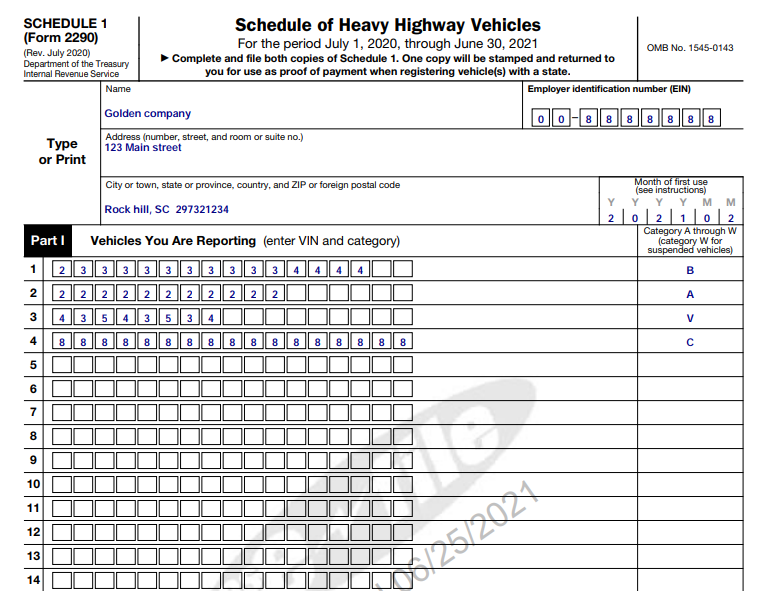

Form 2290 - Heavy Highway Vehicle Use Tax Return

HVUT is an annual Federal Excise tax imposed on heavy vehicles operating on public highways with a gross weight of 55,000 pounds or more. Truckers must pay HVUT and file Form 2290 to the IRS each year ro report their taxable vehicles.

Fillable Form 2290

Visit https://www.expressefile.com/irs-form-2290/ to know more about Form 2290.